Get the free tax transcript example

Show details

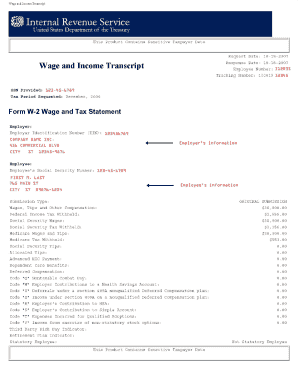

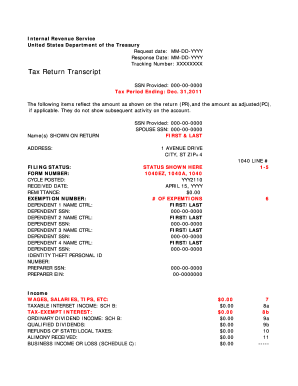

Tax Return Transcript 111-11-1111 1040 201412 LAST SAMPLE 1040 TAX TRANSCRIPT ACCUVERIFY.COM This Product Contains Sensitive Taxpayer Data Tax Return Transcript Request Date: MM-DD-YYYY SSN Provided:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax return transcript example form

Edit your what does a tax return transcript look like form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how can i get a copy of my w2 online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what does a tax transcript look like online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax return example form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wage and income transcript example form

How to fill out what is an IRS?

01

Gather all necessary information and documents such as W-2 forms, 1099 forms, and any other relevant tax documents.

02

Determine the appropriate tax form to use based on your circumstances, such as Form 1040, Form 1040A, or Form 1040EZ.

03

Fill out personal information accurately, including your name, address, social security number, and filing status.

04

Report all sources of income, including wages, salaries, tips, self-employment income, and any other taxable income.

05

Deduct eligible expenses such as student loan interest, mortgage interest, medical expenses, and charitable contributions.

06

Calculate your total tax liability and determine if you owe additional taxes or are entitled to a refund.

07

Complete any required schedules or additional forms based on your specific tax situation, such as Schedule C for business income or Schedule A for itemized deductions.

08

Review and double-check all information for accuracy and completeness before submitting your return.

09

Sign and date your tax return, either manually or electronically, depending on your chosen filing method.

10

Keep a copy of your completed tax return and all supporting documents for your records.

Who needs what is an IRS?

01

Individuals who have earned income and are required to file income tax returns with the Internal Revenue Service (IRS).

02

Small business owners or self-employed individuals who need to report their business income and expenses.

03

Individuals who have received taxable income from sources other than their regular employment, such as rental properties, investments, or freelance work.

04

Taxpayers who qualify for certain deductions or credits and want to take advantage of potential tax savings.

05

Americans living abroad who may still have tax obligations to the IRS.

06

Executors or administrators of estates who are responsible for filing the final income tax returns for deceased individuals.

07

Individuals who want to claim a tax refund or apply for certain tax benefits like the Earned Income Tax Credit or the Child Tax Credit.

Fill

tax transcript sample

: Try Risk Free

People Also Ask about tax return transcript

What is the difference between IRS transcript and tax return?

Answer: A tax return transcript shows most line items from your tax return (Form 1040, 1040A or 1040EZ) as it was originally filed, including any accompanying forms and schedules. It does not reflect any changes you, your representative or the IRS made after the return was filed.

Is a return transcript the same as a w2?

You can get a wage and income transcript from the IRS: It will not show the actual W-2, 1099's, etc, but will show the income information the IRS received. It will not, however, show your state information. It will only show the federal information.

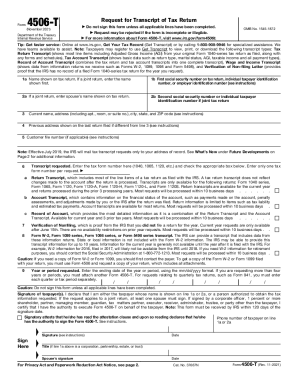

How do I get a tax return transcript?

What You Get. You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. Visit our Get Transcript frequently asked questions (FAQs) for more information.

What is the return transcript and account transcript?

A return transcript usually meets the needs of lending institutions offering mortgages and student loans. Tax Account Transcript - shows basic data such as return type, marital status, adjusted gross income, taxable income and all payment types. It also shows changes made after you filed your original return.

Is a transcript the same as a return?

Note: A transcript isn't a photocopy of your return. If you need a copy of your original return, submit Form 4506, Request for Copy of Tax Return. Refer to the form for the processing time and fee. Refer to Get Transcript FAQs for more information.

What is a return transcript?

• Tax Return Transcript: A tax return transcript shows most line items including AGI. from an original tax return (Form 1040, 1040A or 1040EZ) as filed, along with any forms and schedules. It doesn't show changes made after the filing of the original return.

Why don't I have a return transcript?

If you filed your tax return electronically, IRS's return processing takes from 2 to 4 weeks before a transcript becomes available. If you mailed your tax return, it takes about 6 weeks.

Fill out your tax transcript example form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Transcript is not the form you're looking for?Search for another form here.

Keywords relevant to irs transcript sample

Related to example of tax return transcript

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.